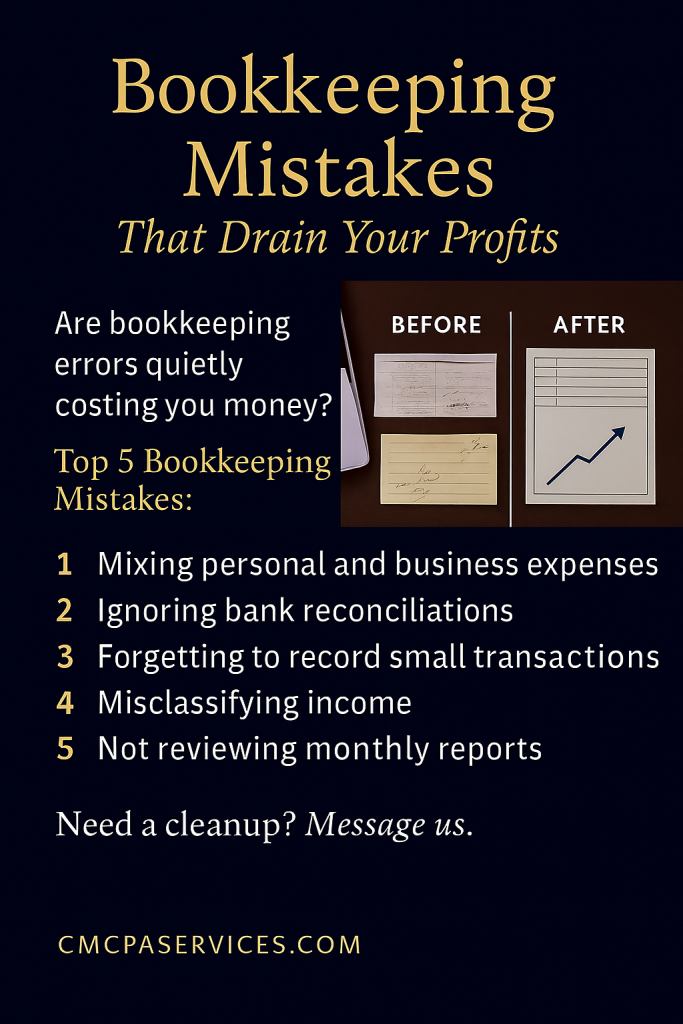

⚠️ Are bookkeeping errors quietly costing you money?

For many small business owners, bookkeeping feels like a back-office chore — something to “get through” rather than a strategic tool. But messy books don’t just create confusion… they can lead to missed deductions, inaccurate reports, and costly tax surprises.

Here are the Top 5 Bookkeeping Mistakes we see most often:

1️⃣ Mixing Personal and Business Expenses

Using one account for everything might feel convenient, but it’s a recipe for audit risk and missed deductions.

Fix: Open a dedicated business account to stay organized.

2️⃣ Ignoring Bank Reconciliations

If your books don’t match your bank statements, you’re flying blind.

Fix: Reconcile monthly to catch errors, duplicates, or missing transactions.

3️⃣ Forgetting to Record Small Transactions

Coffee with a client? A quick app subscription? These add up — and they’re deductible.

Fix: Use a mobile-friendly tool and log expenses on the go.

4️⃣ Misclassifying Income and Incorrect expense categorization

Not all revenue is created equal. Mislabeling income and using the wrong categories can distort your financial reports and impact your tax filings.

Fix: Set clear categories and review them monthly with your bookkeeper.

5️⃣ Not Reviewing Monthly Reports

Your Profit & Loss, Balance Sheet, and Cash Flow reports aren’t just paperwork — they’re decision tools.

Fix: Schedule a monthly review to spot trends, plan ahead, and stay tax-ready.

Avoiding these mistakes means fewer headaches and clearer insight into your business health. Remember, clean books are not just for taxes — they’re for strategy.

🧹 Need a Cleanup? We’ve Got You.

If your books feel more “Before” than “After,” don’t wait until tax season to fix it.

CMCPA Services offers fast, accurate cleanup and ongoing support — so you can focus on growth, not spreadsheets.

📊 At CMCPA Services, we help business owners understand their numbers, not just record them.

📩 Message us today to get started!