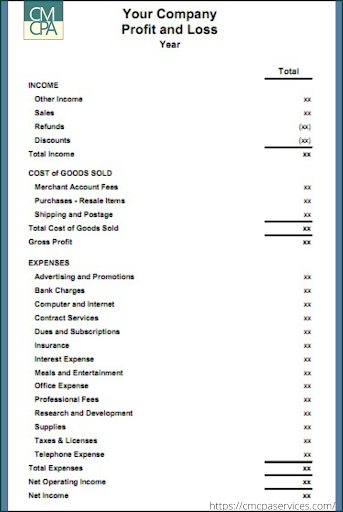

Before canceling your QuickBooks Online subscription, export or print key reports like the Balance Sheet, Trial Balance, Profit & Loss, and General Ledger to ensure you have access to your financial data for future reference, tax filings, or audits.

Here’s a breakdown of the reports you should consider exporting or printing:

Essential Reports:

- Balance Sheet: Provides a snapshot of your assets, liabilities, and equity at a specific point in time.

- Profit & Loss (Income Statement): Shows your revenue, expenses, and net income or loss over a specific period.

- General Ledger: A comprehensive record of all financial transactions, essential for audits and detailed analysis.

Other Useful Reports:

- Sales Tax Liability: If applicable, ensures you have records of your sales tax obligations.

- Statement of Cash Flows: Tracks the movement of cash in and out of your business.

- Inventory Valuation Summary: If you have inventory, this report helps track its value.

- Customer Balance/Vendor Balance: Provides a summary of outstanding balances for customers and vendors.

- A/R Aging Summary and A/P Aging Summary: Helps track outstanding accounts receivable and payable.

How to Export Data:

- Go to the Gear icon .

- Select “Export Data” under Tools .

- Set the date range: in the Reports tab.

- Add or remove items from the Reports and Lists tabs .

- Click “Export to Excel” .

You may download any report that is important to you. If you need some assistance, we can help!