If you’re managing multiple properties, separate bank accounts for each property can save you during tax time!

✅ Easier tracking of income/expenses

✅ Faster reconciliations

✅ Cleaner financial reports

If you’re managing multiple properties, separate bank accounts for each property can save you during tax time!

✅ Easier tracking of income/expenses

✅ Faster reconciliations

✅ Cleaner financial reports

Before canceling your QuickBooks Online subscription, export or print key reports like the Balance Sheet, Trial Balance, Profit & Loss, and General Ledger to ensure you have access to your financial data for future reference, tax filings, or audits.

Here’s a breakdown of the reports you should consider exporting or printing:

Essential Reports:

Other Useful Reports:

How to Export Data:

You may download any report that is important to you. If you need some assistance, we can help!

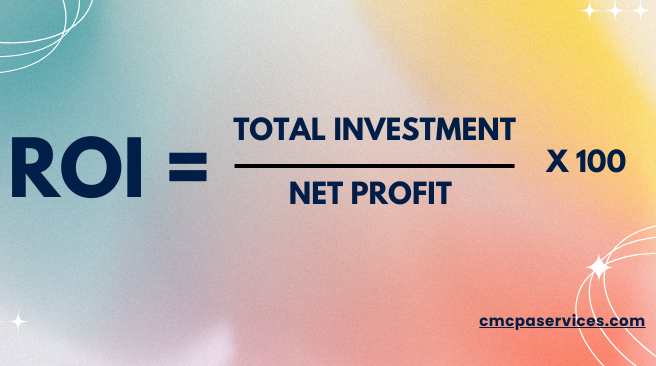

RETURN ON INVESTMENT (ROI) in real estate measures the profitability of a property investment. It’s calculated using the formula:

A higher ROI means your real estate investments are generating strong returns, while a lower ROI may indicate inefficiencies or areas for improvement.

As a bookkeeper and accountant specializing in real estate, we help investors, landlords, and agents maximize their ROI through:

By partnering with an experienced bookkeeper and accountant, real estate business owners can gain financial clarity, improve cash flow, and make smarter investment decisions—all leading to a higher return on investment.

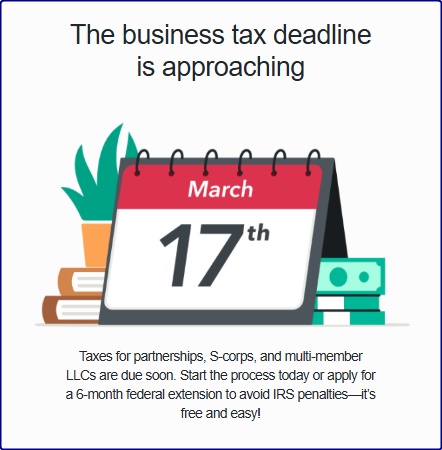

❗️❗️❗️

March 17th is the deadline for business tax or this year, is your books ready? We still have very few slots until March 10 available for your bookkeeping and tax preparation need. DM me for inquiries

Business taxpayers can file electronically any Form 1099 series information returns for free with the IRS Information Returns Intake System. The IRIS Taxpayer Portal is available to any business of any size. It’s secure, reduces the need for paper forms and requires no special software.

With IRIS, business taxpayers can:

Get started

Taxpayers will need a IRIS Transmitter Control Code to access the IRIS Taxpayer Portal. This 5-digit code provides an extra layer of security for filing and can only be use on this portal.

First time users can use Publication 5717, IRIS Taxpayer Portal User Guide, for detailed instructions about access and features.

E-filing required for 10 or more returns

If you have 10 or more information returns, you must file them electronically. This includes Forms W-2, e-filed with the Social Security Administration.

Find details on the final e-file regulations.

Source: IRS

Attention Tax Preparers, Advisors and EA’s:

Are you tired of doing the books for your tax clients? Then we could be the solution, we can help! Outsource accounting and bookkeeping to us. We will handle the books for you so that you can do the things that matters to you most. Having us as your partner will free your firm of the time doing the hard work and many more. Our partner firms are enjoying the benefits, be one of them!

Talk to you soon,

CMCPA Services

Back taxes is a term for taxes that were not completely paid when due. Typically, these are taxes that are owed from a previous year. Causes for back taxes include failure to pay taxes by the deadline, failure to correctly report one’s income, or neglecting to file a tax return altogether.

Most of this happen because of lack or incomplete recording in the books that it is hard for the tax accountant to get the information it needs to complete the filing of return.

What are the implications of this?

If back taxes are owed, the taxpayer’s debt will continue to increase with the inclusion of interest and tax penalties. Late payment penalties include 1/2 of 1% for each month the taxes remain due past the due date. If the taxpayer never filed taxes, there is also a significant late filing penalty.

You will also risk losing your refund and other benefits if you don’t file your return. If you are due a refund for withholding or estimated taxes, you must file your return to claim it within 3 years of the return due date. The same rule applies to a right to claim tax credits such as the Earned Income Credit.

What do you need to do?

First, consult with your tax accountant what needs to be done.

Second, look for someone to complete your books.

(Hint: We are an expert when it comes to accounting and bookkeeping.)

Lastly, act now. The longer you delay filing, the larger your interest and penalties will be!

What is Profit First Method by Mike Michalowicz?

Profit First Method is based on the idea to pay yourself first before paying your expenses. The goal is to grow a more profitable business, not a cash-eating monster. To run your business based on what you can afford now, not what you hope you can afford someday.

Profit First Principles

By taking your profit first, the money available for expenses is artificially reduced. It flips the old adage accounting formula;

Sales – Expenses = Profit into Sales – Profit = Expenses. Hence, you are forced to be innovative, strategic and be mindful of your spending.

How Profit First Method Works

It was inspired by a fitness advertising on tv where in order to reach the goal, one must:

1. Use small plate

2. Serve sequentially

3. Remove temptation

4. Enforce a rhythm

Actionable steps:

1. Set up five different accounts for these purposes.

-Main income

-Profits

-Owner’s salary

-Taxes

-Operating expenses

2. Use those accounts for that purpose only.

Profit First method could be a tool to a more profitable business but the downside;

Maintaining the books of the business can sometimes be a daunting task. Having too many accounts to maintain can be burdensome. Not to mention that if the purpose of some of these accounts is served, you need to revert it to the business main depository account. And it is also important to note that Profit First method is not an accounting method but rather a more cash management system.

How to implement it in the books, particularly, Quickbooks Online and how often? It really depends on what type is your business and how often you want it to be.

How much percentage will you take from your business? This requires assessment of the health of your business. Remember that, money taken out of your business is money you cannot use for the business. You may adjust your percentages along the way should you find yourself unable to cover your expenses.

The biggest question is how will you use the profit you have saved? You decide.

Recommendation (Steps We Can Do)

Profit First can be very useful but let’s make it simple for books purposes, to save you time and money. We can talk about it, contact us now!

P.S. For now, Quickbooks Online is not integrated with Profit First method. Maybe because it is not an accounting method and used for internal purpose only.

File when ready, don’t wait until October 17 to file a 2021 tax return.

For people who requested an IRS extension to file, the October 17, 2022, deadline may seem far away, but it’s coming up fast.

Taxpayers who haven’t filed, whether they requested an extension or not, should file a complete and accurate return as soon as possible.

For people who have all their paperwork in hand, filing sooner and filing electronically could help them avoid possible processing delays later.

And for those who have not done their books for 2021, we can help!

Are you a new business owner or have been in business for so long but using other accounting software other than Quickbooks Online and would want to switch? Then this is for you!

Setting up or switching to Quickbooks Online is easy as long as you have the information you need. It becomes complicated though when old records are messy. It’s doable, here’s the way to do it.

1. Sign up for Quickbooks Online and choose the plan that suits your business. There is a 30-day free trial that you can try to get the hang of it.

2. Set up you company profile (new) or migrate (old) your files to Quickbooks Online .

3. Link your bank and credit card accounts to get automatic bank feeds. This will save you and your bookkeeper tons of time!

4. Import your list of employees, vendors and customers. Or you can add names along the way.

5. Set up your invoices, enable receipts, taxes and other stuff.

Follow these process and you’re ready to go but if you’re having trouble, contact us and we will help you on your first step to financial clarity!