If you’re managing multiple properties, separate bank accounts for each property can save you during tax time!

✅ Easier tracking of income/expenses

✅ Faster reconciliations

✅ Cleaner financial reports

If you’re managing multiple properties, separate bank accounts for each property can save you during tax time!

✅ Easier tracking of income/expenses

✅ Faster reconciliations

✅ Cleaner financial reports

Before canceling your QuickBooks Online subscription, export or print key reports like the Balance Sheet, Trial Balance, Profit & Loss, and General Ledger to ensure you have access to your financial data for future reference, tax filings, or audits.

Here’s a breakdown of the reports you should consider exporting or printing:

Essential Reports:

Other Useful Reports:

How to Export Data:

You may download any report that is important to you. If you need some assistance, we can help!

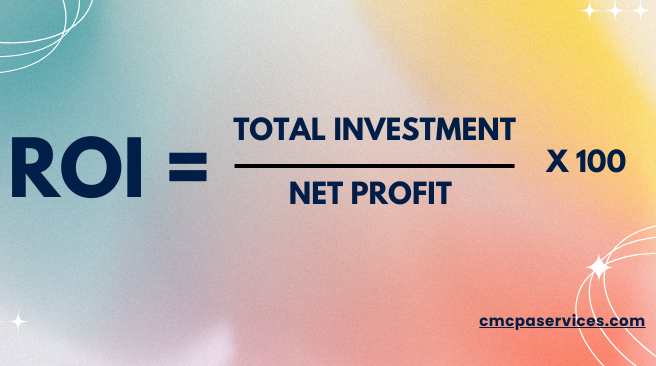

RETURN ON INVESTMENT (ROI) in real estate measures the profitability of a property investment. It’s calculated using the formula:

A higher ROI means your real estate investments are generating strong returns, while a lower ROI may indicate inefficiencies or areas for improvement.

As a bookkeeper and accountant specializing in real estate, we help investors, landlords, and agents maximize their ROI through:

By partnering with an experienced bookkeeper and accountant, real estate business owners can gain financial clarity, improve cash flow, and make smarter investment decisions—all leading to a higher return on investment.

Attention Tax Preparers, Advisors and EA’s:

Are you tired of doing the books for your tax clients? Then we could be the solution, we can help! Outsource accounting and bookkeeping to us. We will handle the books for you so that you can do the things that matters to you most. Having us as your partner will free your firm of the time doing the hard work and many more. Our partner firms are enjoying the benefits, be one of them!

Talk to you soon,

CMCPA Services

Back taxes is a term for taxes that were not completely paid when due. Typically, these are taxes that are owed from a previous year. Causes for back taxes include failure to pay taxes by the deadline, failure to correctly report one’s income, or neglecting to file a tax return altogether.

Most of this happen because of lack or incomplete recording in the books that it is hard for the tax accountant to get the information it needs to complete the filing of return.

What are the implications of this?

If back taxes are owed, the taxpayer’s debt will continue to increase with the inclusion of interest and tax penalties. Late payment penalties include 1/2 of 1% for each month the taxes remain due past the due date. If the taxpayer never filed taxes, there is also a significant late filing penalty.

You will also risk losing your refund and other benefits if you don’t file your return. If you are due a refund for withholding or estimated taxes, you must file your return to claim it within 3 years of the return due date. The same rule applies to a right to claim tax credits such as the Earned Income Credit.

What do you need to do?

First, consult with your tax accountant what needs to be done.

Second, look for someone to complete your books.

(Hint: We are an expert when it comes to accounting and bookkeeping.)

Lastly, act now. The longer you delay filing, the larger your interest and penalties will be!

Are you a new business owner or have been in business for so long but using other accounting software other than Quickbooks Online and would want to switch? Then this is for you!

Setting up or switching to Quickbooks Online is easy as long as you have the information you need. It becomes complicated though when old records are messy. It’s doable, here’s the way to do it.

1. Sign up for Quickbooks Online and choose the plan that suits your business. There is a 30-day free trial that you can try to get the hang of it.

2. Set up you company profile (new) or migrate (old) your files to Quickbooks Online .

3. Link your bank and credit card accounts to get automatic bank feeds. This will save you and your bookkeeper tons of time!

4. Import your list of employees, vendors and customers. Or you can add names along the way.

5. Set up your invoices, enable receipts, taxes and other stuff.

Follow these process and you’re ready to go but if you’re having trouble, contact us and we will help you on your first step to financial clarity!

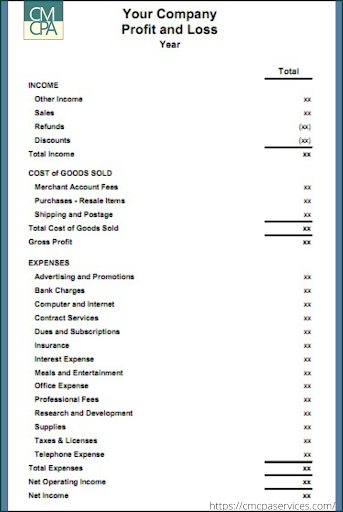

One of the hardest industry when it comes to accounting and bookkeeping is eCommerce. Why? Because the market and trade is ever changing and has become complex overtime. It is better to have it setup by an expert for a clean start but if you want to do it yourself, then you got to start with something. The best route is to begin with your Profit and Loss Statement accounts because this will be the most used accounts in the course of your business.

What is a Profit and Loss Statement?

A P&L or Income Statement will show your Revenue, Costs and Expenses. The bottom line of this report will show you if you made a profit or a loss, hence, the name.

Here are the basic items you will get to see on a Profit and Loss Statement for ecommerce business.

This is not all-inclusive but this will go along way and you could add more accounts when needed. Just make sure to classify it correctly and be consistent with your recording.

If things get messy and you want to save time and money, contact us!

We made it easier for you! Our client onboarding process is simple and straightforward because we don’t want to waste our time and your time, either. Now, let’s dive in.

Easy-peasy, right? We will be glad to have you on board!

Most of our client’s sales have increased because of the “Buy Now, Pay Later” option. If you are selling on Shopify, this is highly recommended. Turn it on because…

☑️Customers will love your store for giving them options and convenient checkout.

☑️Increase your sales and minimize cart abandonment.

Enable it now! #ecommercesolutions #accountingservices #bookkeepingsolutions

Read more about it: https://help.shopify.com/en/manual/payments/shop-pay-installments