What is ROI in Real Estate?

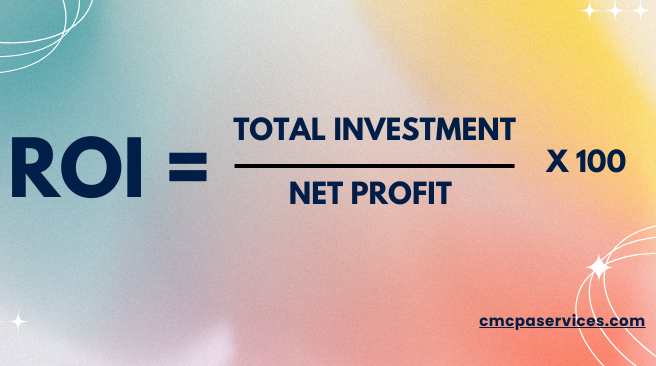

RETURN ON INVESTMENT (ROI) in real estate measures the profitability of a property investment. It’s calculated using the formula:

A higher ROI means your real estate investments are generating strong returns, while a lower ROI may indicate inefficiencies or areas for improvement.

How a Bookkeeper & Accountant Can Help Real Estate Businesses Increase ROI

As a bookkeeper and accountant specializing in real estate, we help investors, landlords, and agents maximize their ROI through:

- Accurate Expense Tracking

- Categorizing operating costs (maintenance, property management fees, utilities, etc.)

- Identifying tax-deductible expenses to minimize liabilities

- Cash Flow Optimization

- Monitoring rental income vs. expenses to ensure profitability

- Implementing strategies to reduce vacancies and late payments

- Smart Tax Planning & Deductions

- Maximizing deductions like depreciation, mortgage interest, and property taxes

- Structuring investments to optimize tax benefits

- Financial Analysis & Investment Decisions

- Evaluating properties based on ROI and cash flow projections

- Advising on whether to hold, sell, or refinance properties

- Budgeting & Forecasting for Growth

- Creating financial plans to scale a real estate portfolio

- Forecasting potential market trends to make informed investment decisions

- Ensuring Compliance & Reducing Risks

- Keeping records up to date for audits and legal compliance

- Helping navigate financial regulations in real estate

By partnering with an experienced bookkeeper and accountant, real estate business owners can gain financial clarity, improve cash flow, and make smarter investment decisions—all leading to a higher return on investment.