Be prepared. Stay compliant. Maximize your deductions.

By CMCPA Services – Helping U.S.-Based Entrepreneurs Stay Tax-Ready Year-Round

🗂️ 1. Organize Your Business Documents

✔️ Business Registration (EIN, LLC, S-Corp docs)

✔️ Prior Year’s Tax Return (Federal & State)

✔️ Articles of Incorporation or Partnership Agreement

✔️ IRS Correspondence (if any)

📊 2. Update Your Bookkeeping

✔️ All income and expenses recorded

✔️ Bank & credit card statements reconciled

✔️ Categorized transactions (with receipts if possible)

✔️ Accurate chart of accounts

✔️ Up-to-date financial reports (P&L, Balance Sheet, Cash Flow)

🧾 3. Collect Your Tax Documents

✔️ 1099-K / 1099-NEC / 1099-MISC forms

✔️ W-2s (if you have employees)

✔️ Business loan statements & interest paid

✔️ Asset purchases or disposals (equipment, vehicles)

✔️ Estimated tax payments made (IRS & State)

💼 4. Track Deductions & Credits

✔️ Home office expenses (sq. ft. + bills)

✔️ Mileage or vehicle expenses (with logs)

✔️ Internet, phone, and software tools

✔️ Professional services (legal, accounting, etc.)

✔️ Business meals, travel, and marketing costs

✔️ Depreciation on business assets

✔️ Employer credits (if applicable)

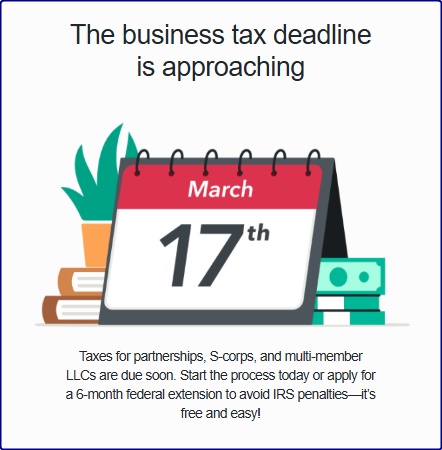

📆 5. Key Deadlines to Remember

📌 January 31 – 1099s & W-2s due to contractors/employees

📌 March 15 – S-Corp / Partnership tax return deadline

📌 April 15 – Individual & single-member LLC tax return

📌 Quarterly – Estimated taxes due: Apr 15, Jun 15, Sep 15, Jan 15

👩💼 BONUS: Work With a Professional

Don’t wait until the last minute. Avoid costly mistakes and missed deductions.

🎯 Book a FREE Consultation with CMCPA Services

📅 Schedule here: Book a Call

📧 Email: mcmworkz@gmail.com

🌐 Website: cmcpaservices.com