What is Profit First Method by Mike Michalowicz?

Profit First Method is based on the idea to pay yourself first before paying your expenses. The goal is to grow a more profitable business, not a cash-eating monster. To run your business based on what you can afford now, not what you hope you can afford someday.

Profit First Principles

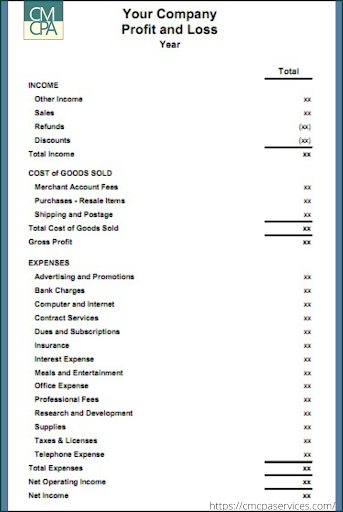

By taking your profit first, the money available for expenses is artificially reduced. It flips the old adage accounting formula;

Sales – Expenses = Profit into Sales – Profit = Expenses. Hence, you are forced to be innovative, strategic and be mindful of your spending.

How Profit First Method Works

It was inspired by a fitness advertising on tv where in order to reach the goal, one must:

1. Use small plate

2. Serve sequentially

3. Remove temptation

4. Enforce a rhythm

Actionable steps:

1. Set up five different accounts for these purposes.

-Main income

-Profits

-Owner’s salary

-Taxes

-Operating expenses

2. Use those accounts for that purpose only.

Profit First method could be a tool to a more profitable business but the downside;

Maintaining the books of the business can sometimes be a daunting task. Having too many accounts to maintain can be burdensome. Not to mention that if the purpose of some of these accounts is served, you need to revert it to the business main depository account. And it is also important to note that Profit First method is not an accounting method but rather a more cash management system.

How to implement it in the books, particularly, Quickbooks Online and how often? It really depends on what type is your business and how often you want it to be.

How much percentage will you take from your business? This requires assessment of the health of your business. Remember that, money taken out of your business is money you cannot use for the business. You may adjust your percentages along the way should you find yourself unable to cover your expenses.

The biggest question is how will you use the profit you have saved? You decide.

Recommendation (Steps We Can Do)

Profit First can be very useful but let’s make it simple for books purposes, to save you time and money. We can talk about it, contact us now!

P.S. For now, Quickbooks Online is not integrated with Profit First method. Maybe because it is not an accounting method and used for internal purpose only.